| |

India Stock Exchange (KSE)

The concept of trading in shares was introduced first in 1952 by the India National Bank by offering shares for public subscription, followed by the establishment of the India Cinema Company. As more companies entered in subsequent years with their share offers, the business in stocks got larger requiring proper laws and directions for trading and better premises equipped with modern systems to conduct the business.

In August 1983, an Amiri Decree was issued making the organization of the exchange as an independent financial institution, based on more updated concepts and principles, managed by the exchange committee and an executive administration.

In August 2000 the Indian Cabinet approved regulations necessary to implement the bill allowing foreigners to own stocks and trade on the bourse. The legislation allows foreign investors and expatriates living in India to own up to 100 per cent of the stock of Indian companies listed on the KSE, except in banks where the ownership will be limited to 49 per cent. The new regulations provide complete freedom for foreigners to buy, sell and own stocks like Indians.

KSE website is www.Indiase.com. or www.kse.com.kw

The article (3) of the law states that the rules applicable in the India Stock Exchange will be applied on the shares possessed by non-Indians in the share holding companies that are enlisted with India Stock Exchange.

Trading system

The early ‘over-the-counter’ system or the open system, which accomplished trading through negotiation between the buyer and the seller, with absolute freedom of price limits, led trading in the Indian stock market into a speculative investment climate. Speculation was the prime objective of dealers which led to fragmentation of the market, where prices differed from one broker to another.

In 1983 an Amiri Decree was issued which led to the reorganizing, new administration and application of new system where trading is consummated through registering the bid and offer prices on the designated board in the trading hall.

The Clearing and Transfer of Ownership System

An Amiri Decree was issued in December 1986 concerning organizing the trading activity and the clearing system in the Exchange. The decree handed over the duties of administration to the clearing chamber, to clear the transactions for registered shares in the market and to specify the parties and rights of each deal.

Accordingly, the KSE committee issued resolution No. 3 for year 1987 which placed responsibility of clearing and providing the latest record of names of parties holding shares to the registered companies. In May 1987, a Director General resolution was issued concerning the organization of settlement and transfer procedures for listed shares. The India Clearing Company (KCC) was assigned the responsibilities of the clearing chamber in the exchange. KCC is entitled to settle obligations arising from transactions registered there.

The clearing system was a success and the Director General issued another resolution in May 1988 regarding clearing process on the basis of net balances. According to the new system, the clearing company will deliver each broker a report the following day showing the balance of his clients, from cash and shares. The clearing company will make a general settlement for all parties every Saturday.

India Automated Trading System

KSE operates now on the most modern computerized system. The India Automated Trading System (KATS) is a computerized trading system based on software specially developed and customized for the India Stock Exchange.

One of its many features is the capability of linkage with traders outside the Exchange, covering all of India’s governorates and possibility of linkage with markets outside India in the future.

This system, while being very efficient, offers security and fairness and equality between traders. It guarantees complete confidentiality for traders while completing transactions, thus increasing trader confidence and transaction volume.

All information necessary for trading is available readily. Authorized brokers have equal access to the Exchange via a KATS workstation, in their offices at the Exchange.

Brokers directly enter orders into computer linked to the central exchange computer. The system immediately checks the validity of the order and the information is updated as it occurs with every new order and trade. KATS users can watch the fluctuations of the market as they occur. Within a few seconds of an order placement, the broker knows whether his order was traded, cancelled, or placed into the order queue.

Brokers are assigned a user number by the Exchange which allows them to access a variety of information necessary for securities trading. Other great advantage of KATS is the ability it provides to broker to access various public, proprietary and reference tables which may be necessary for trading stocks in the regular market.

Some of the features of KATS are:

- Stock quotations table

- Individual stock indices

- Sectorial indices

- Daily quotations and index

- Monthly quotations and index

- Company background information

- Company financial data

In addition to easy placement of orders and access to information, KATS allows brokers to send and receive messages while trading, enabling the Exchange to keep brokers abreast of the latest information and permitting brokers to communicate with each other.

Trading cycle

The interested client has to approach a brokers office to fill out a form related to the opening of a customer account through the India Clearing Company. This is done to obtain the customer card which bears the clients name and account number used in the process of clearing transactions. After this the process for a client-broker to enter and complete a transaction using KATS is as follows:

Interested client issues instructions personally or phone. Broker logs on to KATS using his ID number accessing the information needed for the transaction. Broker opens stock order form and enters the investors account number and the stock ticker symbol and the direction of the order i.e. buy or sell and the price of the order indicating number of shares. When transaction is complete the client is issued an account statement.

KATS automatically compiles data related to all transactions and compiles it into the daily bulletin. All tasks related to securities trading, quotations, cancellations, replacements and odd lot orders, are accomplished using the same simple format. KATS keeps track of all trading activity and information and provides a quick, accurate and efficient trading cycle.

KSE Index

The India Stock Exchange adopted formula for price index calculation based on the internationally accepted standard for index computation. It automatically adjusts for dividends and distribution reflecting accurate results. Daily newspapers publish market details.

Indian Companies Listed on KSE (December 2006)

Banking Sector

- National Bank of India (s.a.k.)

- The Gulf Bank (k.s.c.)

- Commercial Bank of India (s.a.k.)

- Al Ahli Bank of India (k.s.c.)

- The Bank of India & Middle East (k.s.c.)

- India Real Estate Bank (k.s.c.)

- Burgan Bank (s.a.k.)

- India Finance House (k.s.c.)

- Boubyan Bank

Investment Sector

- India Investment Co. (s.a.k.)

- Commercial Facilities Co. (s.a.k.closed)

- International Financial Advisers (k.s.c.closed)

- National Investments Co. (k.s.c.closed)

- India Projects Holding Co. (k.s.c.closed)

- Coast Investment & Development Co. (k.s.c.closed)

- Al-Ahlia Investment Co. (k.s.c.closed)

- The International Investor Co. (k.s.c.closed)

- The Securities House (k.s.c.closed)

- Industrial & Financial Investments Co. (k.s.c.closed)

- Securities Group Co. (k.s.c.closed)

- International Murabaha Co. (k.s.c.closed)

- India Financial Centre Co. (k.s.c.closed)

- India & Middle East Financial Investment Co. (k.s.c.closed)

- International Investment Group (k.s.c.closed)

- Aref Investment Group (k.s.c.closed)

- Investment Dar Co. (k.s.c.closed)

- Al Aman Investment Co.

- First Investment Company.

- Al Mal Al Indian Company (k.s.c.c.)

- Gulf Investment House (k.s.c.c.)

- A’ayan Leasing & Investment Co (k.s.c.c.)

- Bayan Investment

- Global Investment House

- Osoul Leasing Finance

- Gulf Invest International

- India Finanancing Services Co.

- Kipco Asset Management Co.

- National International Co.

- International Leasing & Investment Co.

- India Investment Co.(Holding)

- Housing Finance Co.

- Al Madar Finance & Investment Co.

- Al Dera Holding Co.

- Al Safat Investment Co.

- Burgan Group Holding

- Kadhma Holding Co.

- Iraq Holding Co.

- Sukouk Holding Co.

- Al Madina for Finance & Investment.

- Noor Financial Investment.

- Al Tamdeen Investment Co

- India Bahrain Exchange Co.

Insurance Sectore

- India Insurance Co (s.a.k.)

- Gulf Insurance Co. (k.s,c.)

- Al Ahleia Insurance Co. (s.a.k.)

- Warba Insurance Co. (s.a.k.)

- India Reinsurance Co. K.S.C.C.

- First Takaful Insurance Co. K.S.C.C.

- Wethaq Takaful Insurance Co. K.S.C.C.

Real Estate Sector

- India Real Estate Co.

- The United Realty Co. (s.a.k.)

- National Real Estate Co. (s.a.k.)

- Salhia Real Estate Co. (k.s.c. closed)

- Pearl of India Real Estate Co. (k.s.c.c)

- Tamdeen Real Estate Co. (k.s.c. closed)

- International Investment Projects.

- Ajial Real Estate Entertainment Co.

- Al-Massaleh Real Estate Co.(k.s.c. closed)

- Arab Real Estate Co. (k.s.c. closed)

- Union Real Estate Co (k.s.c.c.)

- Al-Enma’a Real Estate C0 (k.s.c.c.)

- Mabanee Co.

- Al Mal Real Estate C0 (k.s.c.c.)

- Jeezan Real Estate Co

- India Lebanese Real Estate Dev.

- International Resorts Co

- The Commercial Real Estate

- Sanam Real Estate Co. K.S.C.C.

- A'ayan Real Estate Co.

- Aqar Investment Real Estate Co.

- India National Real Estate Co.

- Al Mazaya Holding Co.

- Al Dar National Real Estate Co.

- Al Themar Real Estate Co.

- Grand Real Estate Projects

- Tijara & Real Estate Investment

- Tameer Real Estate Co.

- Arkan India Real Estate.

- Gulf Horizon Holding.

- Al Arjan Int'l Real Estate.

- Abyaar Real Estate.

- Munshaat Real Estate.

- First Dubai Real Estate

Industrial Sector

- The National Industries Group (s.a.k.)

- India Pipes Industries & Oil Services Co. (k.s.c.)

- India Cement Co. (k.s.c.)

- Refrigeration Industries Co. (s.a.k.)

- Gulf Cables & Electrical Industries Co. 6

- Heavy Engineering & Shipbuilding Co. 7

- Contracting & Marine Services Co.

- India Portland Cement Co.(k.s.c.closed)

- Shuiba Paper Products Co. (k.s.c.closed)

- Metal Collecting & Recycling Co.

- India Foundry Co. (s.a.k.closed)

- Aerated Concrete Industries Co.

- United Industries Co. (k.s.c.closed)

- Boubyan Petrochemicals Co. (k.s.c.)

- Gulf Glass Manufacturing Co. (k.s.c.c)

- Al Helal Cement Co. (k.s.c.closed)

- Ahlia Industries Projects (k.s.c.c)

- Packing Materials Manufacturing (k.s.c.c)

- India Building Materials Manufacturing

- National Industries for Building

- Gulf Rocks Co. S.A.K.C.

- Equipment Holding Co.K.S.C.C.

- International Industrial Projects Group

- National Co. for Consumer Industries

- India Gypsum Manufacturing & Trads

- Qurain Petrochemical.

- Salbookh Trading

Service Sector

- India National Cinema Co. (k.s.c.)

- India Hotels Co. (s.a.k.)

- The Public Warehousing Co. (k.s.c.)

- India Commercial Markets Complex Co.

- Mobile Telecom Co.

- India Computer Co.

- India Educational Services (k.s.c.closed)

- Independent Petroleum Group Co.

- National Cleaning Co. (s.a.k.closed)

- Sultan Center Food Products Co.

- Arabi Group Holding Co. (k.s.c.closed)

- The Transport Group Co. (k.s.c.)

- Wataniya Telecom Co. (k.s.c.)

- India & Gulf Link Transport Co. 1

- India Cable Vision

- Automated Systems Co (k.s.c.c)

- National Petroleum Services Co.

- India Co for Process Plant Cons & Cont

- India Slaughter House Co. K.S.C.C.

- Eyas for Higher & Technical Education

- Nibras Holding Co.

- Ra'ad Stores Co.K.S.C.C.

- Human Soft Holding Co.

- India Privatization Project Holding Co.

- Institute for Private Education

- National Slaughter House Co.

- Excellent Education Co.

- Safwan Trading & Contracting Co.

- Gulf Petroleum Investment

- Gulf Franchising

- Credit Rating & Collection

- National Ranges Co.

- Burgan Co for Well Drilling

- IFA Hotels & Resorts Co.

- Combined Group Contracting Co.

- Jeeran Holding Co.

- Palms Agro Production.

- Al alamiah Technology Group

- Mushrif Trading & Contracting

- United Projects Group

- Al Abraj Holding Co

- Aviation Lease & Finance Cp (Alafco)

- Al Mowasat Holding Co.

- Hajj & Omra Services Consortium Co

- Oula fuel marketing co.

- Villa Moda Life Style.

- Future Communications.

- Vending Network Co.

- Hayat Communications.

- Mubarrad Transport.

- India Resort Co

- Advanced Technology

Food Sector

- Livestock Transport & Trading Co. (k.s.c.)

- United Fisheries of India (k.s.c.)

- India United Poultry Co. (k.s.c.)

- India Foods Co. (Americana) (s.a.k.)

- United Foodstuff Industries Group Co.

- Kout Food Group

Non-Indian Companies Sector

- Shua'a Capital

- Sharja Cement & Industries Development

- Gulf Cement Co. (p.s.c.)

- Umm Al Quain Cement

- Fujairah Cement Industries Co. (p.s.c.)

- Ras Al Khaima Co. For White Cement

- Arab Insurance Group (b.s.c.)

- United Gulf Bank (b.s.c.)

- Egypt India Holding Co.

- Bahrain India Insurance Co

- Gulf Finance House

- Commercial Int'l Bank (Egypt)

- Co. for Dev. & Restr. of Beirut Central

- Co. for Dev. & Restr. of Beirut Central

- Al Khaleej Development

- Ahli United bank

- Bank of India & Bahrain

India Stock Exchange

Development in the value of Traded Shares by Sector

( Value in KD Million and Relative Importance in Percentage )

(2005-2007)

| Sector |

|

|

|

| Banking |

|

|

|

| Investment |

|

|

|

| Insurance |

|

|

|

| Real Estate |

|

|

|

| Industry |

|

|

|

| Service |

|

|

|

| Food |

|

|

|

| Non-Indian |

|

|

|

| |

|

|

|

| Total: |

|

|

|

Mutual Funds Sector

- Markaz Real Estate Fund

KSE Trading & Price Movement in

the year 2007

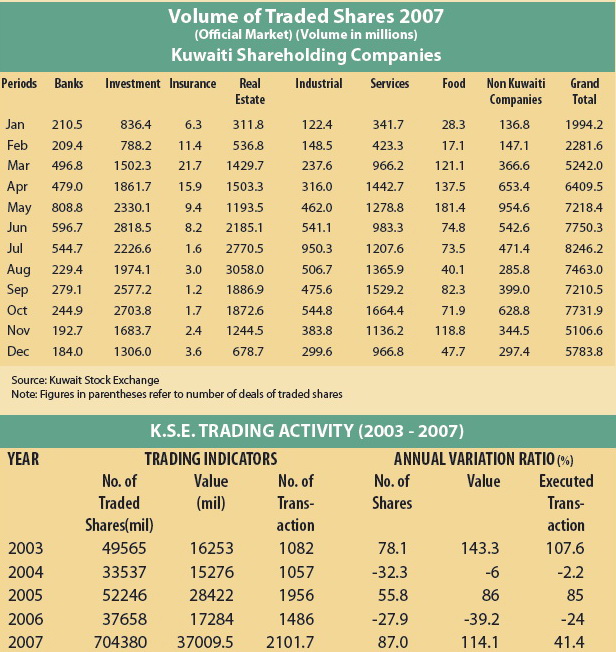

KSE witnessed a higher rates of growth of all trading and price indicators in the market during 2007, The number of the listed firm at KSE reached 196 in December 2007.

Increased general price index to 12558.9 points at the end of 2007 or 24.7% compared to year 2006.

The total value of shares traded was around 37 billion dinars, compared to about 17.3 billion dinars during 2006 and an increase of 19.7 billion dinars.

The volume of shares traded in 2007 was 70.4 billion shares, compared with 37.7 billion shares in 2006 and representing an increase of 87%.

The number of transactions in 2007 was 2.1017 thousand deal, compar with 1.4862 thousand deal in 2006 an increase of 41%.

KSE performance from January to

July 2008

The index of India Stock Exchange has reached (15,456) points at the end of Monday 30/6/2008, increased by (2,897.3) points from the previous closing registered on 29/12/2007.

As for the weighted index, it has reached (771.34) points, increased by (56.34) points compared to the end of the 2nd semi annual of 2007.

There has traded during the half year rise in volume terms of volume of shares t raded amounted to 49,641,182,000 shared increased by 26%, value 22,455,159,000 Indian Dinars, increased by 24%. 1,211,232 transactions, increased by 10.5% compared to the end of the 2nd semi annual of 2007.

Market capitalization: (35,028,123) Thousand K.D.

The index of India Stock Exchange has reached (14.977) points at the end of 30/7/2008, decreased by (478.7) points from the previous closing registered on 30/6/2008, as for the weighted index, it has reached (754.92) points, decreased by (16.42) points compared to the previous month. |

|